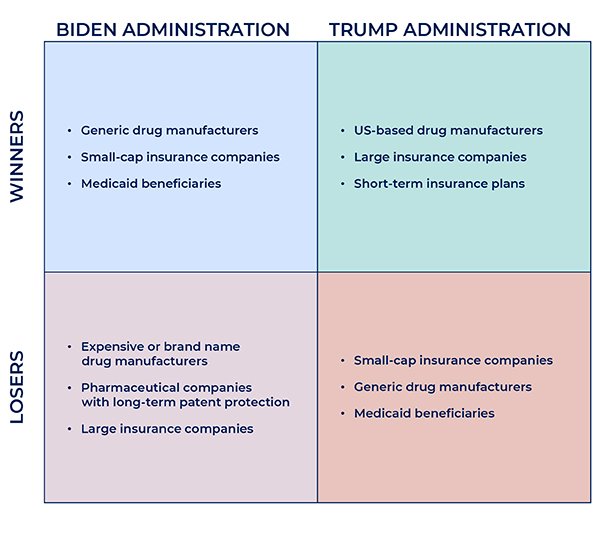

Democrats reclaimed control of the House of Representatives in 2018, and the party’s focus on healthcare policy is often credited for the win. This edition of The 2020 analyzes the implications of the US presidential election on the industry, and assesses the winners and losers that will inevitably come from a Trump or Biden-led administration.

While President Trump and Democratic presidential candidate Joe Biden agree that lowering drug prices is essential, their plans for healthcare infrastructure and other related key areas hold vast differences. Needless to say, US healthcare policy is bound to change regardless of which candidate winds up in the White House. America’s complex health systems have many overlapping layers and competing interests, some that COVID-19 has magnified and most that will likely be addressed in the months and years to come.

A Biden victory: Impact on drugmakers and insurers

If Democrats retain control of the House and gain control of the Senate, a Biden administration will pursue healthcare reform to deliver on promises to two constituencies: progressives who want universal health care, and senior citizens who want lower drug prices.

On drug pricing this would involve:

- The negotiation of purchasing agreements with drug manufacturers using the federally funded programs and agencies to secure lower prices.

- Making samples of brand name drugs more accessible to generic manufacturers

- Creation of a board who will assess the value of new drugs and recommend pricing, the board would review the demand for and cost of a drug and set the market price, similar to the system employed in countries like the UK. Drug prices in the UK are often referenced by other countries when setting their own. The future of the UK’s price reference status is uncertain with UK-EU negotiations ongoing before the end of the transition period with the EU on Dec 31st 2020.

- Allow consumers to import prescription drugs from other countries provided they have been certified as safe by the FDA.

With these changes, generic and foreign drug manufacturers would benefit due to lower market barriers to entry. The patent-holding manufacturer on the other hand will likely suffer from the increased competition. However, any revenue loss could be offset by an expansion in the number of consumers stemming from proposed changes to the insurance market, which include:

- Expanding the Affordable Care Act (passed during the Obama administration) to include a public option similar to Medicare (government health insurance for senior citizens) and available to Americans who can’t afford commercial insurance.

- An increase in subsidies to help Americans buy plans on the insurance exchanges where consumers can compare and buy insurance plans. The subsidy is paid in the form of a tax on the uninsured.

- Roll back regulations implemented under President Trump, including a rule that enables insurers to offer coverage plans that exclude protection for pre-existing conditions.

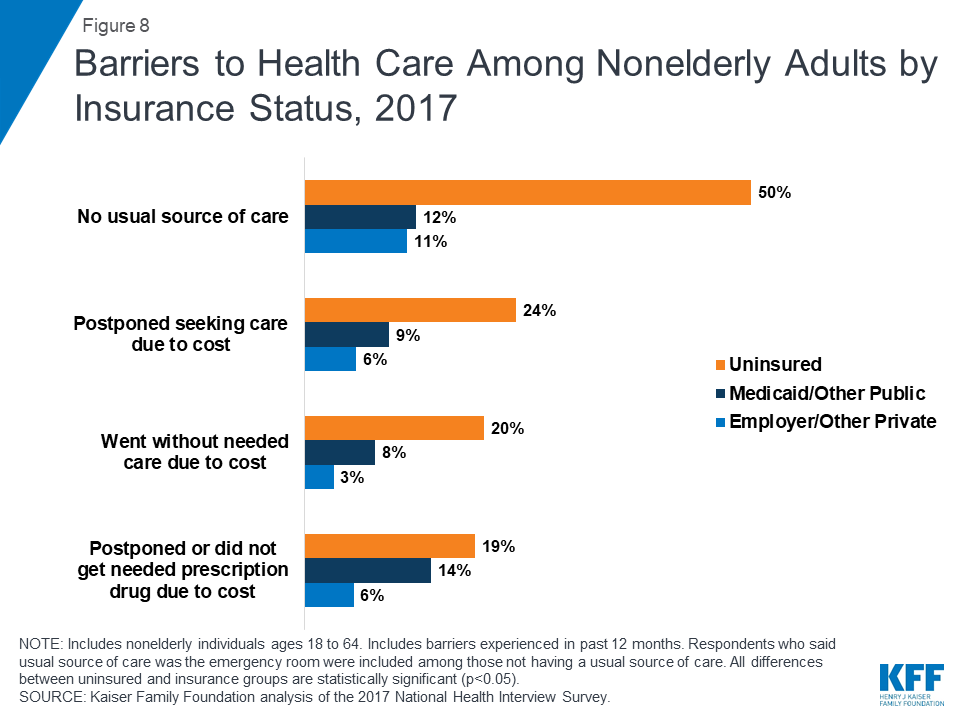

Over 1 million Americans have lost health insurance coverage during the Trump administration as rule changes have made insurance plans on the Obamacare exchanges more expensive or less comprehensive. Millions more have lost employer-based health insurance as COVID-19 continues to weigh on the job market. Reversing this will be a priority for Biden and will help to shore up the vocal progressive movement in the Democratic party. Wider access to healthcare will in turn lead to an expanded consumer base for pharmaceutical companies . People without health insurance are less likely to seek medical care (fig. 1) and therefore less likely to be prescribed treatments for ailments.

A Trump victory: Impact on drug manufacturing and approval

The Trump administration has attempted to dismantle the Affordable Care Act through every mechanism available to it, but the core of the law remains intact. This is likely to continue in a second Trump term. The push for this rests on the notion that the exchanges have increased insurance premiums for middle class Americans: fewer claims, means lower premiums. Reducing the number of options on exchanges and changing regulations to allow limited plans benefits established players in the insurance market.

Here’s what we can expect for insurers during a second Trump term:

- Defunding the Affordable Care Act to reduce the number of people buying insurance on the exchanges.

- Ending consumer protection mandates and allowing insurance companies to offer limited plans that don’t offer comprehensive coverage.

- Cuts to federal insurance programs such as Medicaid (state funded insurance for low-income Americans) as well as increasing restrictions on who qualifies for Medicaid.

Reducing access to insurance is a boon to established players in the insurance market because they face less competition. Anyone seeking comprehensive coverage will need to enlist a large insurance company or go through an employer. Limiting Medicaid may reduce government expenditure, but it also reduces the purchasing power of Medicaid, as fewer dependents mean fewer claims and therefore fewer consumers that the drug manufacturer can sell to. This might harm efforts to lower drug prices.

Expected Trump administration measures related to pharmaceuticals could include:

- Streamlining FDA approval process to increase the supply of drugs on the market and bring prices down. This includes increased approvals for generics; more than 1,600 generic drug applications have been approved since January 2017, when Trump took office.

- Trump signed four executive orders in July of this year intended to lower drug prices. The orders i nclude allowing consumers to import approved drugs from other countries and create an international pricing index (pharmaceutical leaders presented their alternative on Monday which included voluntary price reductions of 10% on certain drugs). This part of Trump’s plan is similar to Biden’s; signaling a potential avenue for bipartisan cooperation between Republicans and Democrats.

- Trump also hopes to boost US manufacturing of drugs which would confer advantages to drug companies with established manufacturing operations in the US. This can be associated with the administration’s wider goals on supply chain protection.

The Trump administration wants to lower drug prices but also wants to incentivize US manufacture of drugs. He has done this through “buy American” executive orders, which have accelerated because of escalating tensions with China amid the pandemic and the perceived reliance on drugs manufactured in China. This has also manifested in trade policy where Trump has negotiated deals that extend patent protections thus increasing the time frame for generics to come to market. The hope is that this will increase US drug exports to global markets and strengthen America’s manufacturing base, but it might delay any price reductions to drugs by increasing the market advantage of established players.

The Covid effect

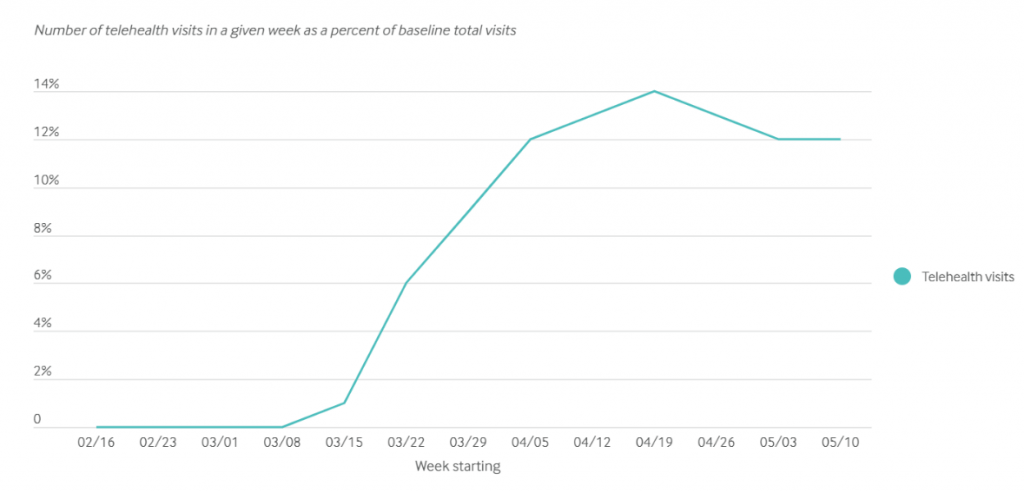

The pandemic is exposing gaps in access to quality healthcare in America, and inefficiencies in procuring vital equipment. It’s also driving the increasing digitalization of medicine and healthcare systems. Telehealth appointments have grown in frequency (fig.2) during the pandemic and could see sustained gains even when COVID-19 subsides. Not having a usual source of care was a barrier to healthcare access for 50% of uninsured Americans and telehealth could play a role in removing that barrier. Taken together, this would reduce the burdens on hospitals which currently face long waiting times and high costs.

Visits: A Rebound Emerges,” To the Point (blog), Commonwealth Fund, May 19, 2020. https://doi.org/10.26099/ds9e-jm36

The primacy of healthcare in 2018 and now again in 2020 will increase the pressure on both parties to find a solution to problems that affect all Americans. A bipartisan compromise on drug pricing is more likely than a bipartisan deal on insurance. Pharmaceutical companies don’t typically donate to presidential candidates or publicly comment on their respective policy platforms because the industry is an easy target for politicians looking to earn populist bona fides. Companies have contributed $10 million to Senate and Congressional candidates and their committees to quietly sustain Congressional support regardless of who wins the White House. This could create a legislative barrier to ambitious healthcare reforms, but if congressional action is non-existent, then both men running for the presidency will use executive powers to pursue their agendas on drug pricing.