While international conversation around Africa has focused on follow ups and in-depth pieces around international relations, this has not been the case locally.

This week, we saw a consistent focus around the inherent challenges African economies are facing when enforcing lockdown measures. Access to finance, food supply and protection of informal workers are major concerns in many countries.

We’re zooming in on the reaction to government public safety measures, and what this means for the coming weeks across the continent.

Lockdowns extend across Africa driving negative sentiment

While some governments warned of the difficulty in enforcing confinement policies, many African countries have taken sweeping measures to halt the spread of COVID-19, with lockdowns in place in Kenya, Nigeria, South Africa and elsewhere.

Despite these efforts, the crisis is deepening and the WHO said this week that Africa could be the virus’ next epicentre.

The impact of public safety measures on African economies and societies is increasingly playing out online. The term “lockdown” has been a keyword in conversations around COVID-19, with mentions increasing almost 5 per cent compared to the previous week. Negative sentiment around the lockdown increased by 22 per cent, with positive sentiment decreasing by 40 per cent.

News that the lockdown in Nigeria had been extended in all major cities for a further two weeks was a main topic of conversation. The number of mentions of the lockdown from Nigeria matched that of the US.

South Africa also announced an extension of its lockdown until the end of April, generating multiple trending hashtags including #LockdownSA and #COVID19SouthAfrica. The move came under harsh criticism from the country’s opposition party, who warned of the damaging economic impact of this decision.

Vulnerable communities feeling let down

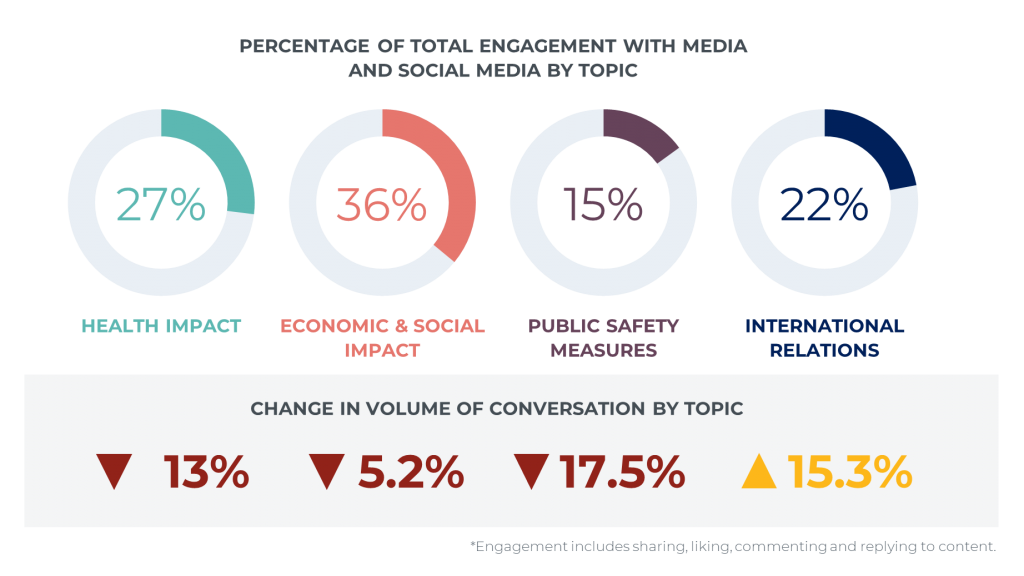

Conversation around the wider economic and social impact of public safety measures also increased, representing more than a third of the total engagement with media and social media over the last week.

Many in Africa make their living in the informal economy. In several countries where only a small minority of workers have access to employer-provided benefits, African governments are being accused of not stepping up to support the most vulnerable.

Last week, Ugandan president Yoweri Museveni confirmed that no cash payments will be provided to the over 30 million people in the country that earn a living through the informal economy.

Impact on food supply

Lockdowns across Africa are also blocking farmers from getting food to markets, and with many schools closed, 65 million children are now missing out on meals.

It is therefore no surprise that food security also emerged as an area of concern last week with articles around this topic generating high levels of engagement in Nigeria, Kenya, South Africa, Ghana and Zimbabwe.

In response we are already seeing eased restrictions. The largest market in Burkina Faso was reopened last week. While South Africa announced it will gradually ease regulations after its five-week national lockdown and Ghana become the first African country to lift its lockdown this week.

As countries globally slowly start considering when to end their COVID-19 restrictions, we expect to see more discussion around Africa’s alternatives to the lockdown.

A closer look elsewhere

As Nigeria entered its third week of COVID-19 lockdown, with all commercial activities and business operations halted, calls for financial support for the country’s most vulnerable multiplied.

A movement calling for the Nigerian government to start paying benefits through an identification system called BVN (Bank Verification Number) gained significant traction. With #PayUsViaBVN trending across Nigeria for a number of days, the government are under significant pressure to act.

This comes as the distribution of emergency cash handouts is increasingly digitised across the continent, from Namibia to Kenya, a reflection of the African “mobile money boom” of the past few years.